Here’s a familiar scene in every data-driven company: An account manager has 5 minutes before a client call. They need to understand what’s happening with the account — performance metrics, issues, opportunities. They open their analytics dashboard and… that’s where time starts disappearing.

The problem isn’t a lack of data. Modern dashboards are incredibly powerful; they can slice, dice, and visualize data in countless ways. The problem is more fundamental: the human cost of building context.

For example,

-

An account manager opens the transactions dashboard

-

Sees an anomaly in the success rate

-

Opens another dashboard to check support tickets

-

Finds related issues, but needs historical context

-

Opens yet another view to check past patterns

-

Finally starts connecting the dots

Each context switch costs time and mental energy. Each new query requires reformulating the question. And most importantly — the relationship between these data points lives entirely in the account manager’s head.

This is why we started rethinking the problem from first principles.

What if, instead of building better dashboards, we changed how humans interface with data entirely?

At realfast, we’ve been building agents on Agentforce that transform this workflow. Not by adding AI to dashboards, but by fundamentally changing the data access pattern. To understand how it works, look at this interaction with our merchant analytics agent.

Picture an account manager at a payments company juggling 50+ small and medium merchants, each using multiple products. Before a merchant meeting, they have hardly 5 minutes to prepare their key talking points. They need a quick business pulse check — transaction trends, support issues, and growth opportunities.

Traditionally, this means navigating through multiple dashboards, manually piecing insights together, and risking critical gaps in information.

With an AI agent, this process is simplified to a conversation. The account manager can just ask for a rundown of key metrics, eliminating dashboard navigation entirely.

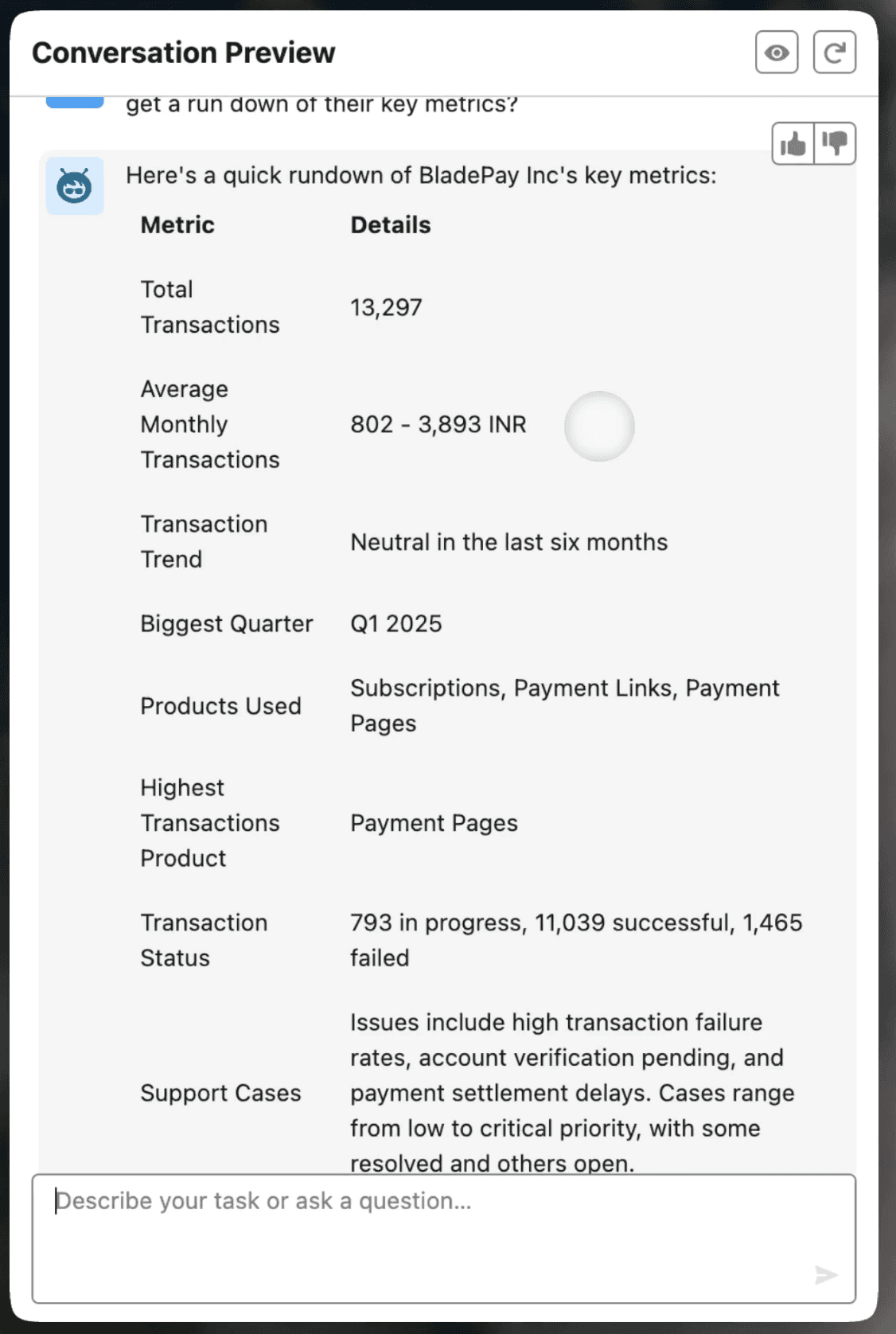

The AI agent then instantly summarises the most relevant metrics, reducing information overload.

The account manager now has a quick overview of their merchant’s business with the most critical numbers front and center.

As they scan through the AI-generated summary, one issue immediately stands out — failed transactions. These have appeared in recent support cases, raising a red flag because transaction failures directly impact merchant satisfaction. If unresolved, they could lead to churn.

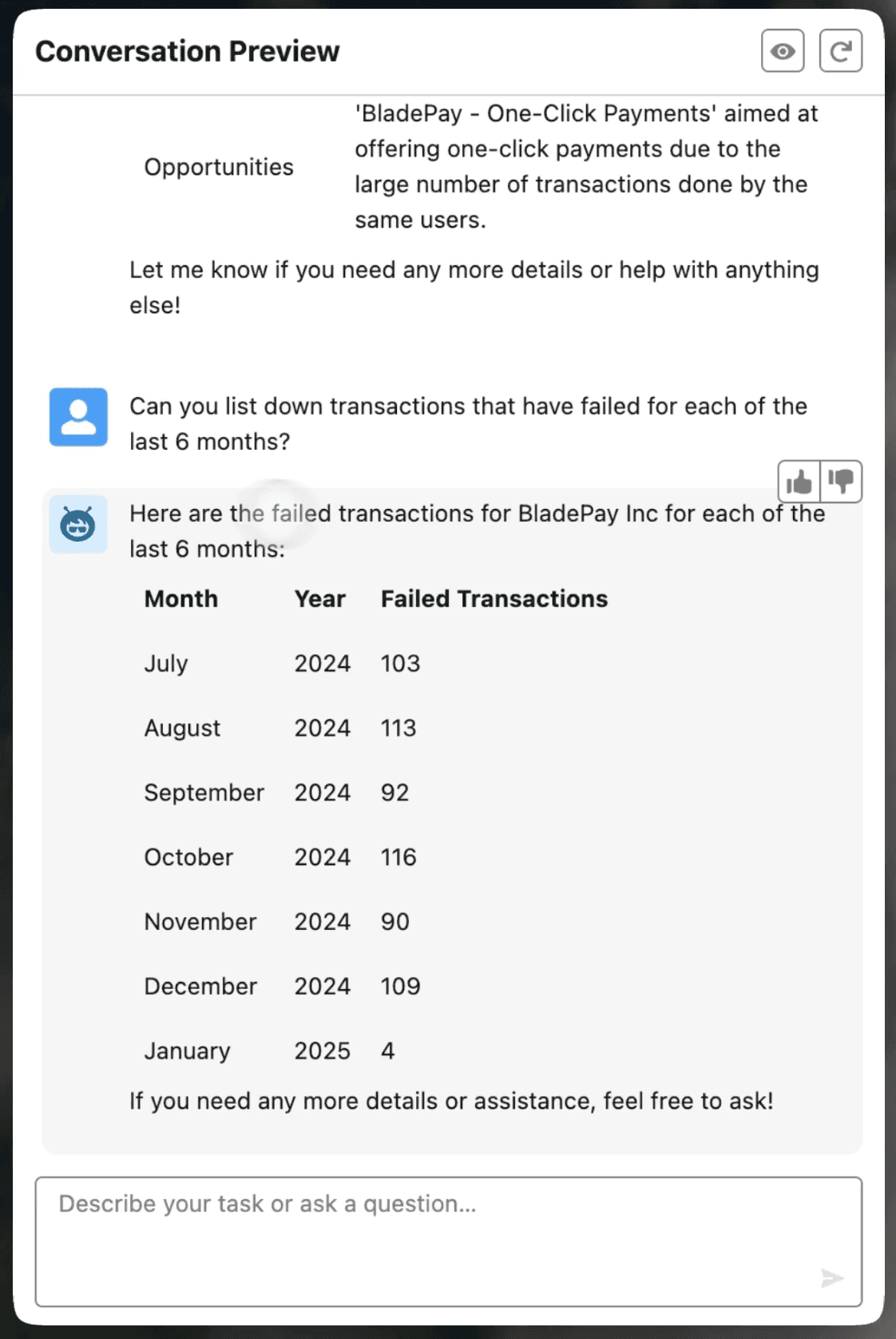

Instead of clicking through dashboards and digging into reports, the account manager can prompt the agent to drill down further. And in seconds, the agent pulls up a breakdown of failed transactions over the past few months, making it easy to spot trends.

The AI agent reveals a consistent trend—month after month, transaction failures persist. This isn’t just an isolated issue; it’s a recurring problem that could impact merchant satisfaction and retention.

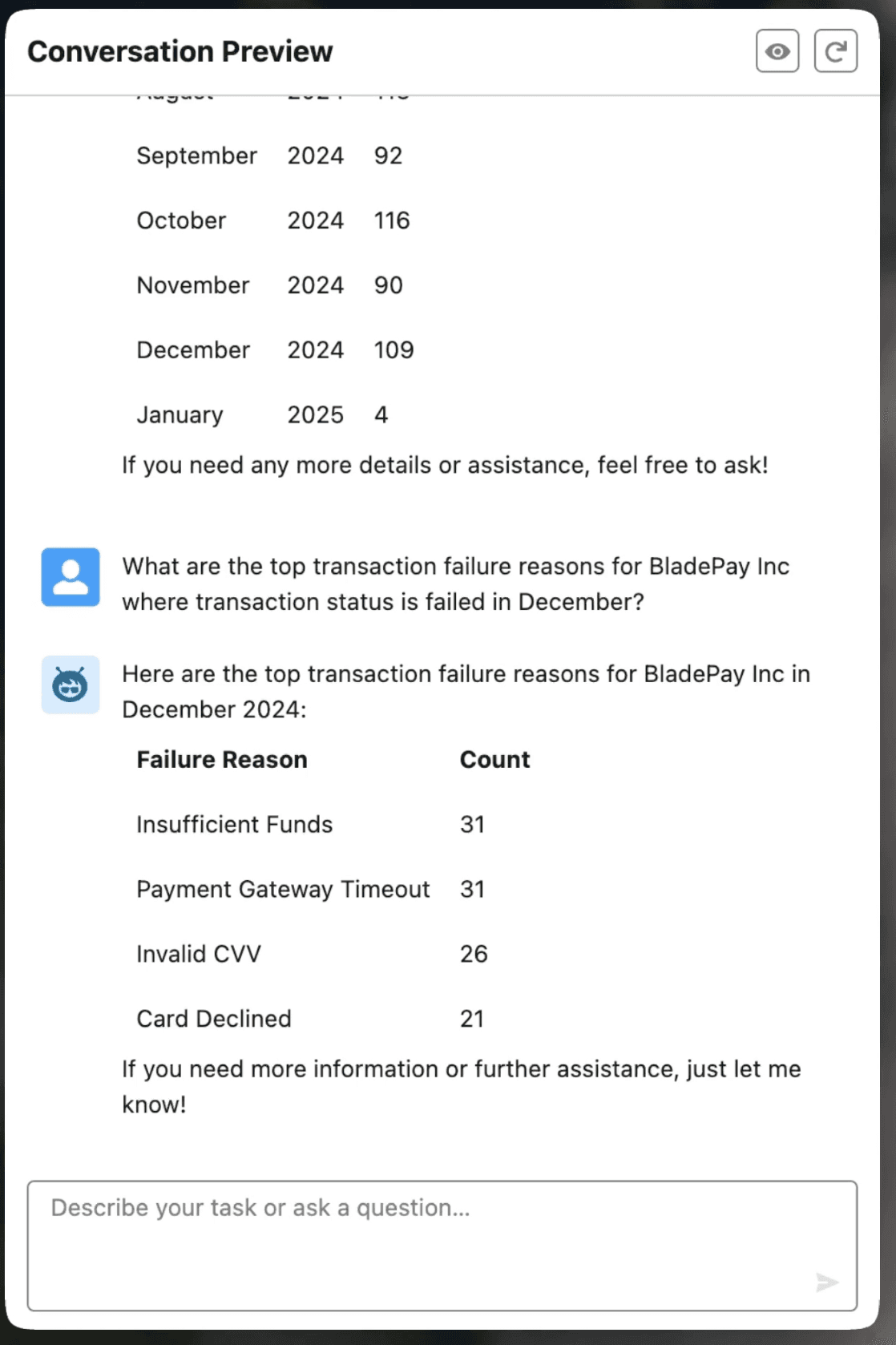

But spotting a trend is only half the job — the account manager now needs to dig deeper to understand the root cause. Instead of manually analyzing reports, they can simply ask the agent:

Why are these transactions failing?

In seconds, the AI agent pinpoints the top reasons. The primary cause? Insufficient funds. Now, the account manager is equipped with the story behind the numbers; they know exactly what to address in their meeting.

Traditional dashboards would handle this through multiple preset queries and views. Instead, our agent implements what we call “context-first querying.”

Here’s what’s happening under the hood:

1. Context Initialization

When the AM mentions “BladePay Inc,” the agent immediately builds a data context that includes:

-

Transaction history

-

Product usage patterns

-

Support ticket records

-

Account metadata

2. Dynamic Query Resolution

What looks like a simple metrics table actually represents multiple resolved data paths. Notice how the agent

-

Surfaces critical metrics first (13,297 total transactions)

-

Includes trend indicators (“neutral in last six months”)

-

Flags potential issues (1,465 failed transactions)

The engineering challenge here isn’t just data retrieval - it’s maintaining context through the conversation. When the AM asks about transaction failures, they don’t need to specify a timeframe or other parameters. The agent maintains session context and understands this is a drill-down request related to the previous data pull.

Why conversations beat dashboards

We’ve been building dashboards the same way for decades: define metrics, create views, build drill-downs. It’s like we took SQL and gave it a UI. But that’s not how humans process information.

When that account manager has 5 minutes before a call, they’re not thinking in queries. They’re thinking:

“Is this merchant healthy?”

“What might they be unhappy about?”

“What should I be worried about?”

Traditional dashboards force you to translate these natural thoughts into a series of specific data pulls. It’s computationally expensive. For your brain.

Now, with an agent like this, the AM doesn’t need to:

-

Remember which dashboard has transaction data

-

Know how to filter for the right date range

-

Figure out how to join support ticket data

-

Calculate trends manually

Instead, they can focus on what matters: understanding the story in their data.

But conversational interfaces aren’t magic. They come with their own set of headaches.

Context windows are limited. Natural language is ambiguous. Error handling is more complex. Data freshness becomes trickier.

But we are betting on this approach because the computational load is better distributed. Instead of humans doing the heavy lifting of context-building and pattern-matching, we can offload that to systems designed for exactly this purpose.

Think about our failed transactions example. A human would need to:

-

Pull historical data

-

Identify patterns

-

Check support tickets

-

Look for correlations

-

Form hypotheses

-

Validate assumptions

That’s a lot of CPU cycles in your brain. With a conversational interface, you can focus on the final, most human part: deciding what to do about it.

Agents take us one step closer to building for the real job to be done.

Dashboards aren’t going away. They’re still great for specific use cases — monitoring systems, looking at long-term trends, building reports. But for day-to-day operational decision making, the future looks more like a conversation.

What we’ve built at realfast is just scratching the surface. Our merchant analytics agent shows what’s possible when you rethink data access patterns from first principles. But there’s so much more to figure out:

-

How do we handle complex, multi-step analysis?

-

What happens when you need to compare across hundreds of data points?

-

How do we make these systems truly reliable at scale?

These are hard problems. But they’re worth solving because the alternative — continuing to burn human compute cycles on basic data exploration — makes even less sense.

And while this demo highlights a simple use case, we are already seeing a fundamental shift in how business users interact with their data. We’re building out more complex use cases and pushing the boundaries of what’s possible with Agentforce.

If your business is looking to leverage AI for faster, smarter decision-making, let’s talk!